Hirono: Republican Corporate Tax Giveaway Would Hurt Funding for Hawaii Hospitals, Other Critical State Projects

Hirono: “Rather than crafting a tax plan that would actually help middle class families, Donald Trump and the Republican Party have decided to screw them over instead.”

WASHINGTON, D.C. – Ahead of expected late night votes on the Senate Republican tax plan, Senator Mazie K. Hirono spoke out against the bill’s devastating impact on Hawaii families and critical state infrastructure.

Senator Hirono highlighted the Senate bill’s focus on providing substantial tax relief to corporations and wealthy individuals at the expense of working families and investments that benefit communities in Hawaii and nationwide. While not yet law, buried in the House and Senate Republicans’ massive and rushed tax legislation are provisions that have already created uncertainty and impacted the construction of Hawaii hospitals and other important infrastructure projects.

Senator Hirono highlighted the impact that these little-known provisions of the Republican tax plan would have on the planned West Maui Hospital and Medical Center and Kapiolani Medical Center for Women and Children.

From Senator Hirono’s remarks:

“Rather than crafting a tax plan that would actually help middle class families, Donald Trump and the Republican Party have decided to screw them over instead. All to give rich people and corporations huge tax cuts they do not need. The Republican tax bill hasn’t even passed Congress yet, but the mere threat of eliminating private activity bonds is already having a profoundly negative impact on Hawaii and communities across the country.

“It’s hard to understand how Donald Trump and his Republican allies in Congress could in good conscience cut a program that saves lives to finance tax cuts for the wealthy and corporations.”

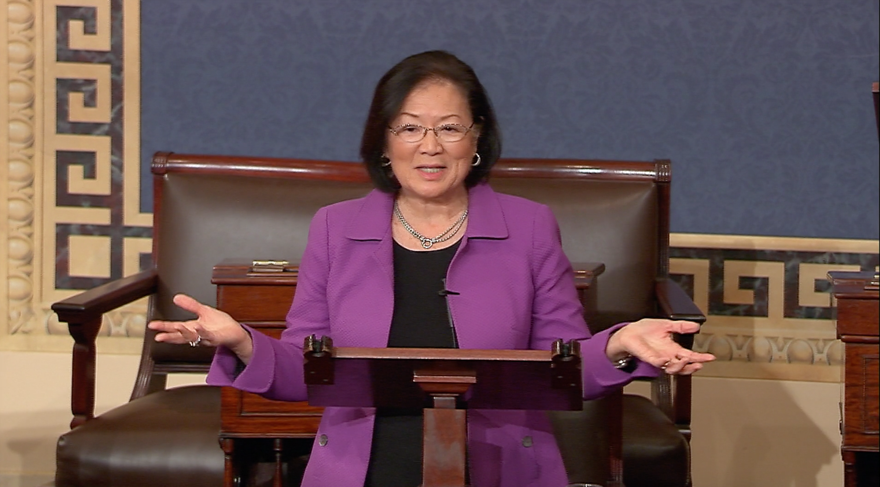

Click on the photo above to watch Senator Hirono’s remarks

Senator Hirono’s full remarks, as prepared for delivery:

Mr. President, the Republican tax plan we are debating today is a sham. It is a solution in search of a problem. The President and his allies in Congress are bound and determined to give the richest people in our country and large corporations huge tax cuts. The theory, certainly not reality, is that these huge tax cuts will magically trickle down to create a fantastic, incredible, tremendous economy.

The fact that this theory has been thoroughly discredited and in reality shown to be false is of little concern to them.

What exactly, then, is the problem this bill is supposed to address? Corporations and the richest 1% of people in our country are doing just fine. They certainly don’t need any more goodies.

Over the past 10 years, corporate profits have grown exponentially. More wealth is concentrated in the hands of the top 1% than at any time since the Great Depression.

Groups like the U.S. Chamber of Commerce claim this bill will spur new investment and help workers. What world are they living in?

Corporations have sheltered $2.6 trillion dollars off shore to avoid paying taxes. This is money they could already be using to create jobs, build factories, or raise employee wages. Not happening, and won’t happen.

These people and corporations do not need more money and profits. On the other hand, middle class families have seen stagnant wage growth for nearly 20 years.

Health care continues to be a political football, with the President sabotaging the Affordable Care Act and Congressional efforts to repeal the law. The cost of a college education is increasingly out of reach for working people. The list goes on.

But rather than crafting a tax plan that would actually help middle class families, Donald Trump and the Republican Party have decided to screw them over instead. All to give rich people and corporations huge tax cuts they do not need.

In Hawaii, we have a word to describe what’s happening here. This is shibai, or B.S.

We’ve had little time to debate the devastating impact of this massive bill. But even in the short amount of time we’ve had, it’s clear how many of the major provisions in this bill would harm working people.

For example, this bill eliminates the individual mandate for health care, which is just another way to repeal the Affordable Care Act. How many bites out of this repeal apple are the Republicans going to take?

Thirteen million people will lose their health insurance. Premiums for everyone else would increase significantly every year. Do they think that these millions of people will not notice what’s happening to them? I don’t think so.

This bill eliminates the state and local tax deduction that thousands of taxpayers in Hawaii count on. These tax giveaways to the rich will force states to make huge and painful cuts to public education, essential social services, and infrastructure investment.

But the devastating impact of this bill is not limited to the parts everyone’s heard about. This Republican tax scam has a number of obscure provisions that are already having or will cause real harm.

The House bill, for example, eliminates the ability of state and local governments to issue private activity bonds. This kind of bond certainly isn’t something you’re likely to hear about on Morning Joe or Wolf Blitzer, but they are very important. Through private activity bonds, the federal government allows states and local governments to issue tax-exempt bonds to finance certain kinds of projects that help our communities.

State and local governments routinely issue private activity bonds to construct public housing, develop mass transit, or construct new schools and hospitals. The Republican tax bill hasn’t even passed Congress yet, but the mere threat of eliminating private activity bonds is already having a profoundly negative impact on Hawaii and communities across the country.

Let me give a concrete example.

Residents of West Maui have been waiting for a hospital for decades. Right now, on their side of the island, if there is a medical emergency, the only way an ambulance can get from West Maui to Maui Memorial – the island’s only hospital— is on a two-lane highway.

One lane winds around the side of a cliff, making it susceptible to falling rocks and flash floods. The other lane is being eaten away by coastal erosion. On a normal day when nothing goes wrong, it can take over an hour to reach Maui Memorial from West Maui. But if there’s traffic or an accident on the highway, you can forget about it.

For serious injuries and illnesses, even an hour is too long to wait for lifesaving medical care. Construction of the West Maui Hospital and Medical Center is clearly important and needed. When the project is completed, West Maui will have a dedicated emergency room and will offer essential surgical and radiological services. It will save lives.

Although initial work to lay the foundation for the hospital began earlier this year, construction has stalled. Why? Because financing for the project is being held up out of fear that Republicans in Congress will eliminate the private activity bonds this project needs for completion.

Brian Hoyle, the President of Newport Hospital Corporation, which is building the West Maui Hospital said, “We’re waiting to see what Congress does. All of the health care community does not like this bill. It’s a very bad bill for the state of Hawaii.”

Other hospitals across Hawaii have used private activity bonds to finance much-needed expansions of service.

With the help of private activity bonds, Kapiolani Medical Center for Women and Children in Honolulu recently finished construction on its Diamond Head Tower, which houses some of the hospital’s most important neonatal functions.

Last year, I visited the new 40,000 square foot Neonatal Intensive Care Unit (NICU). The NICU is five times larger than its former facility and can better serve the more than 1,000 of the most vulnerable babies born at the hospital every year. In only a few days, Kapiolani will open its new emergency room – which is twice the size of its old one -- to the nearly 125 patients who come through their doors every day.

I heard from Michael Robinson, Kapiolani’s Vice President of Government Relations and Community Affairs on how private activity bonds could literally mean the difference between life and death for Hawaii residents. He wrote to me, saying, “Private activity bonds were critical in the construction of Kapiolani Medical Center’s Diamond Head Tower, enabling us to expand our bed capacity and meet the needs of the most critically ill children and their families throughout Hawaii. It’s difficult to understand why Congress is considering eliminating private activity bonds when this method of financing has been essential in providing non-profit hospitals the resources to provide care to the patients they serve."

As Michael said, it’s hard to understand how Donald Trump and his Republican allies in Congress could in good conscience cut a program that saves lives to finance tax cuts for the wealthy and corporations.

If this bill passes before the end of this calendar year, it could trigger $136 billion in mandatory cuts to essential programs, including $25 billion in cuts to Medicare. Senator Booker, Senator Murray, and I have introduced an amendment that would automatically undo the corporate tax cut if these cuts to Medicare happen.

If we’re serious about a tax plan that will help middle class families in a meaningful way, we need to kill this terrible bill and start over.

I yield the floor.

###